Sherlock Communications specialises in partnering with international organisations to build their presence and grow sustainably in Peru. From our office in Lima, our team combines on-the-ground insight, strong media connections and digital know-how with the strategic and creative standards expected by global brands. Because we work exclusively with overseas clients, we understand the challenges of managing Latin American markets from abroad and specialise in translating international objectives into campaigns that resonate locally.

As one of the fastest-growing economies in Latin America, Peru presents international brands with both opportunity and challenges. Its GDP is projected to reach US$380 billion by 2030, reflecting strong potential and growing regional influence. Yet high levels of informality, regional inequalities and a fragmented media landscape mean that success here is rarely straightforward. For international organisations, communications strategies must do more than highlight growth, they need to be carefully adapted to diverse communities, shifting digital behaviours and complex local dynamics.

When communicating with a new audience, the starting point is understanding the cultural and demographic context that shapes how people connect, consume and engage. At Sherlock Communications, we place local insight at the heart of our work, ensuring that every campaign reflects Peru’s unique diversity while staying aligned with global brand objectives.

According to INEI, Lima is home to over 10 million people, representing 30.2% of Peru’s population, while nearly 60% live along the coast. When it comes to identity, just over half of Peruvians aged 14 and above describe themselves as mestizo, 27% as indigenous, 6.6% as Afro-Peruvian, 4.6% as white, and another 4.6% from other origins. For international organisations, this linguistic and cultural landscape underscores the importance of tailored communications.

Spanish and Quechua are Peru’s official languages, with Aymara also widely spoken and other Amazonian languages present in specific regions.

For international organisations, this linguistic and cultural landscape underscores the importance of tailored communications. English proficiency remains limited – only 4 in 100 Peruvians speak the language fluently – making it essential for brands to adapt campaigns into Spanish or indigenous languages if they want to resonate and reach the broader population.

When communicating with a new audience, the starting point is understanding the cultural and demographic context that shapes how people connect, consume and engage. At Sherlock Communications, we place local insight at the heart of our work, ensuring that every campaign reflects Peru’s unique diversity while staying aligned with global brand objectives.

According to INEI, Lima is home to over 10 million people, representing 30.2% of Peru’s population, while nearly 60% live along the coast. When it comes to identity, just over half of Peruvians aged 14 and above describe themselves as mestizo, 27% as indigenous, 6.6% as Afro-Peruvian, 4.6% as white, and another 4.6% from other origins. For international organisations, this linguistic and cultural landscape underscores the importance of tailored communications.

Spanish and Quechua are Peru’s official languages, with Aymara also widely spoken and other Amazonian languages present in specific regions.

For international organisations, this linguistic and cultural landscape underscores the importance of tailored communications. English proficiency remains limited – only 4 in 100 Peruvians speak the language fluently – making it essential for brands to adapt campaigns into Spanish or indigenous languages if they want to resonate and reach the broader population.

Overlooking minority groups often means leaving millions of potential clients out of the equation, and this becomes clear when we look at how many communication strategies are still designed today.

According to the National Society of Industries (SNI), about 60 percent of Peru’s GDP is generated in Lima. It is no surprise, then, that many companies focus most of their efforts there. But the remaining 40 percent comes from the country’s other 23 regions, which shows how important it is for businesses to recognise that their audiences are far more spread out. At Sherlock Communications, we help clients widen their lens, ensuring their campaigns truly reach and resonate with people across Peru. By combining regional understanding with tailored strategies, we help brands communicate in a way that feels inclusive, relevant and meaningful, wherever their audience may be.

Income inequality has shaped Peru since its early years as a nation. In 2024, INEI reported that 27.6 percent of the population lived in poverty, more than nine million people facing deprivation. An additional 5.5 percent lived in extreme poverty, representing over one million Peruvians.

Although these numbers show a small improvement from the previous year, especially in urban areas, they still fall short of reflecting the country’s broader economic reality. Peru’s GDP per capita passed USD 8,000 for the first time, but the long-term effects of the COVID-19 pandemic, alongside recurring climate events, continue to highlight the depth of income inequality.

Informality remains another major challenge. Statista estimates that by 2023, more than 70 percent of the workforce was informally employed. In response, authorities have been working to help small and medium-sized businesses enter the formal economy through measures like VAT exemptions, encouraging registration and broader participation.

There is also a growing push to strengthen the country’s startup ecosystem. Acceleration programmes such as Start Up Peru are helping technology companies gain ground and innovate, bringing more people into the digital economy.

For international organisations, this mix of progress and persistent inequality means communications strategies must be sensitive, inclusive and adapted to different socio-economic realities.

Overlooking minority groups often means leaving millions of potential clients out of the equation, and this becomes clear when we look at how many communication strategies are still designed today.

According to the National Society of Industries (SNI), about 60 percent of Peru’s GDP is generated in Lima. It is no surprise, then, that many companies focus most of their efforts there. But the remaining 40 percent comes from the country’s other 23 regions, which shows how important it is for businesses to recognise that their audiences are far more spread out. At Sherlock Communications, we help clients widen their lens, ensuring their campaigns truly reach and resonate with people across Peru. By combining regional understanding with tailored strategies, we help brands communicate in a way that feels inclusive, relevant and meaningful, wherever their audience may be.

Income inequality has shaped Peru since its early years as a nation. In 2024, INEI reported that 27.6 percent of the population lived in poverty, more than nine million people facing deprivation. An additional 5.5 percent lived in extreme poverty, representing over one million Peruvians.

Although these numbers show a small improvement from the previous year, especially in urban areas, they still fall short of reflecting the country’s broader economic reality. Peru’s GDP per capita passed USD 8,000 for the first time, but the long-term effects of the COVID-19 pandemic, alongside recurring climate events, continue to highlight the depth of income inequality.

Informality remains another major challenge. Statista estimates that by 2023, more than 70 percent of the workforce was informally employed. In response, authorities have been working to help small and medium-sized businesses enter the formal economy through measures like VAT exemptions, encouraging registration and broader participation.

There is also a growing push to strengthen the country’s startup ecosystem. Acceleration programmes such as Start Up Peru are helping technology companies gain ground and innovate, bringing more people into the digital economy.

For international organisations, this mix of progress and persistent inequality means communications strategies must be sensitive, inclusive and adapted to different socio-economic realities.

Another notable shift is the rapid adoption of digital wallets. Data from Peru Payments shows that virtual transactions grew by 884% between 2019 and 2024, and today, 72% of Peruvian adults use these platforms. This trend has also boosted financial inclusion, with 67% of the population holding a bank account by 2024.

Twenty years ago, when people talked about Peru, most minds went straight to Machu Picchu. It was the image that defined the country for travellers around the world. But things have changed. Tourism has expanded, reaching new places, new experiences and a cuisine that is now celebrated across the globe. With three distinct natural regions, the coast, the mountains and the jungle, Peru has watched its tourism industry grow steadily over the last decade.

By 2025, the World Travel and Tourism Council (WTTC) estimates that tourism will bring more than USD 23 billion into the Peruvian economy, around 7.8 percent of the country’s GDP. It is a big leap from the USD 3.8 billion recorded in 2014.

In 2024, most travellers came for leisure, which made up over 86 percent of all trips, while business travel represented 13.8 percent. The main visitors that year were from Chile with 25 percent, the United States with 18 percent and Ecuador with 8 percent.

Machu Picchu is still the country’s most iconic attraction, but Peru today offers much more. Its growing gastronomy scene has turned Lima into the culinary capital of the region. At the same time, destinations such as Arequipa, Trujillo, Loreto and Ica are gaining visibility and attracting more international visitors.

Twenty years ago, when people talked about Peru, most minds went straight to Machu Picchu. It was the image that defined the country for travellers around the world. But things have changed. Tourism has expanded, reaching new places, new experiences and a cuisine that is now celebrated across the globe. With three distinct natural regions, the coast, the mountains and the jungle, Peru has watched its tourism industry grow steadily over the last decade.

By 2025, the World Travel and Tourism Council (WTTC) estimates that tourism will bring more than USD 23 billion into the Peruvian economy, around 7.8 percent of the country’s GDP. It is a big leap from the USD 3.8 billion recorded in 2014.

In 2024, most travellers came for leisure, which made up over 86 percent of all trips, while business travel represented 13.8 percent. The main visitors that year were from Chile with 25 percent, the United States with 18 percent and Ecuador with 8 percent.

Machu Picchu is still the country’s most iconic attraction, but Peru today offers much more. Its growing gastronomy scene has turned Lima into the culinary capital of the region. At the same time, destinations such as Arequipa, Trujillo, Loreto and Ica are gaining visibility and attracting more international visitors.

In 2024, Peru’s economy reached close to USD 289.22 billion in GDP and grew 3.3 percent, according to the World Bank. This progress comes from a diverse mix of sectors that keep the country moving, from textiles, chemicals and pharmaceuticals to its well-known mineral production, especially gold and zinc. On the global stage, Peru continues to strengthen its ties through trade with partners such as the United States, Brazil, China, the European Union and Chile.

In 2023, services made up more than half of the country’s total output. Industry followed with 33.86 percent, and agriculture contributed 7.19 percent, based on Statista data.

Even though agriculture represents a smaller share, it plays an important role internationally. Peru has become the world’s top exporter of asparagus and fishmeal. Energy, on the other hand, remains a complex issue. The country has significant reserves of natural gas and oil, yet still relies on imports to meet its needs.

Much of Peru’s industrial activity is concentrated in the Lima metropolitan area, where roughly 8,000 factories operate and most service-related businesses are found. The city has one of the largest export hubs in South America and serves as a key point for regional freight.

Lima is also home to major banks, insurance companies and retailers, with most industrial operations based in the surrounding region. The majority of exports leave the country through the Port of Callao and the Port of Chancay.

In 2024, Peru’s economy reached close to USD 289.22 billion in GDP and grew 3.3 percent, according to the World Bank. This progress comes from a diverse mix of sectors that keep the country moving, from textiles, chemicals and pharmaceuticals to its well-known mineral production, especially gold and zinc. On the global stage, Peru continues to strengthen its ties through trade with partners such as the United States, Brazil, China, the European Union and Chile.

In 2023, services made up more than half of the country’s total output. Industry followed with 33.86 percent, and agriculture contributed 7.19 percent, based on Statista data.

Even though agriculture represents a smaller share, it plays an important role internationally. Peru has become the world’s top exporter of asparagus and fishmeal. Energy, on the other hand, remains a complex issue. The country has significant reserves of natural gas and oil, yet still relies on imports to meet its needs.

Much of Peru’s industrial activity is concentrated in the Lima metropolitan area, where roughly 8,000 factories operate and most service-related businesses are found. The city has one of the largest export hubs in South America and serves as a key point for regional freight.

Lima is also home to major banks, insurance companies and retailers, with most industrial operations based in the surrounding region. The majority of exports leave the country through the Port of Callao and the Port of Chancay.

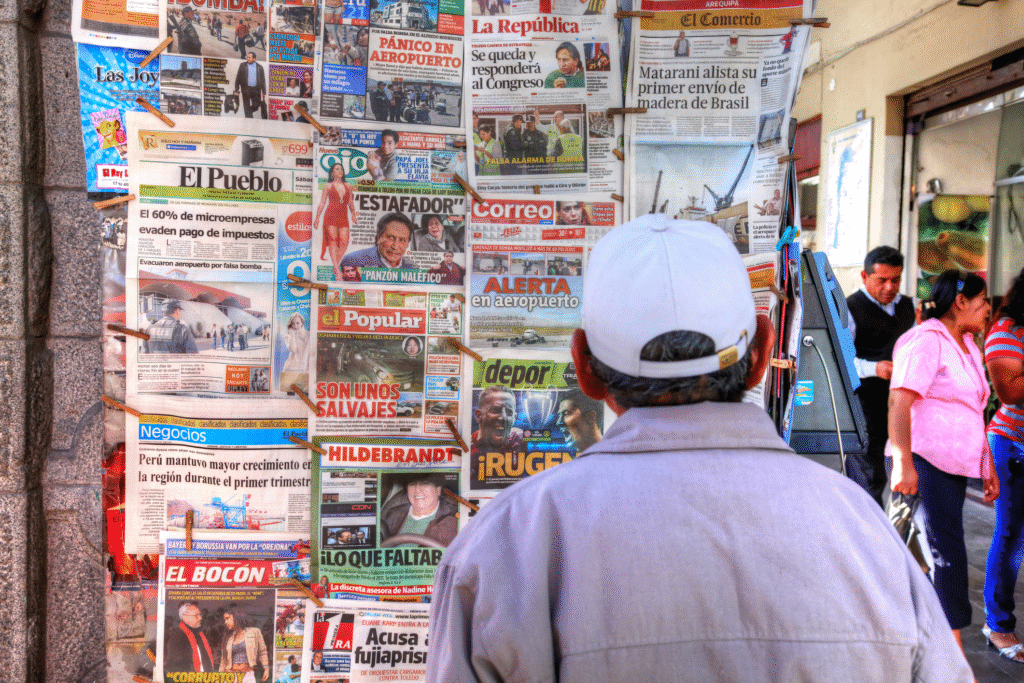

Media consumption in Peru has changed quickly in recent years. The Digital News Report 2025 shows that 81 percent of Peruvians now get their news from websites, social media or video platforms. Television still plays a role for 51 percent of the population, and 24 percent continue to rely on newspapers.

Even though most Peruvians still see television as their main source of information, habits are shifting. Cable TV use has dropped, and streaming services continue to rise. Between 2018 and 2023, the adoption of streaming jumped from 33 percent to 55 percent. This change goes hand in hand with growing internet access, which is expected to reach almost all households by 2026.

Social media has expanded its influence as well. In 2025, 71 percent of Peruvians are active on these platforms. Facebook remains important, but TikTok and YouTube stand out with nearly twenty million users each. Instagram also stays strong, and WhatsApp has become a key channel for sharing updates and information.

Mobile usage follows the same digital trend. By the end of 2024, the country had 42.7 million active mobile lines. The market, once led by prepaid services, is shifting, with postpaid plans reaching 43.2 percent of all lines.

For international organisations, this rapidly changing landscape calls for strategies that combine traditional influence with a strong digital approach. At Sherlock Communications, we monitor these shifts closely, using our research expertise and local knowledge to guide clients toward the right channels and messages, ensuring their campaigns feel relevant across both established and emerging platforms.

Even though most Peruvians still see television as their main source of information, habits are shifting. Cable TV use has dropped, and streaming services continue to rise. Between 2018 and 2023, the adoption of streaming jumped from 33 percent to 55 percent. This change goes hand in hand with growing internet access, which is expected to reach almost all households by 2026.

Social media has expanded its influence as well. In 2025, 71 percent of Peruvians are active on these platforms. Facebook remains important, but TikTok and YouTube stand out with nearly twenty million users each. Instagram also stays strong, and WhatsApp has become a key channel for sharing updates and information.

Mobile usage follows the same digital trend. By the end of 2024, the country had 42.7 million active mobile lines. The market, once led by prepaid services, is shifting, with postpaid plans reaching 43.2 percent of all lines.

For international organisations, this rapidly changing landscape calls for strategies that combine traditional influence with a strong digital approach. At Sherlock Communications, we monitor these shifts closely, using our research expertise and local knowledge to guide clients toward the right channels and messages, ensuring their campaigns feel relevant across both established and emerging platforms.

E-commerce has been growing consistently in the last few years. The Peruvian Chamber of Electronic Commerce (CAPECE), said that this economic sector is really important and during 2024 generated around US$15.6 billion, growing more than 20% in one year. Almost 19 million Peruvians made online purchases and it’s a clear trend.

In the last five years, e-commerce accounted for 5.5% of GDP, more than double the data from 2019, demonstrating a significant increase in just five years. Also, the number of digital shoppers almost tripled, from 6 million to 17 million. In Peru are big international players as Mercado Libre, one of the most popular in Latin America, but retail chains such as Ripley and Falabella and supermarkets have also joined this type of offering, in addition to marketplaces where they not only sell their own products, but also have other external suppliers to increase the offering.

E-commerce has been growing consistently in the last few years. The Peruvian Chamber of Electronic Commerce (CAPECE), said that this economic sector is really important and during 2024 generated around US$15.6 billion, growing more than 20% in one year. Almost 19 million Peruvians made online purchases and it’s a clear trend.

In the last five years, e-commerce accounted for 5.5% of GDP, more than double the data from 2019, demonstrating a significant increase in just five years. Also, the number of digital shoppers almost tripled, from 6 million to 17 million. In Peru are big international players as Mercado Libre, one of the most popular in Latin America, but retail chains such as Ripley and Falabella and supermarkets have also joined this type of offering, in addition to marketplaces where they not only sell their own products, but also have other external suppliers to increase the offering.

Millennials are the main online shoppers, influenced by their acquisitive power and also by their proximity to technology. This group between the ages of 25 and 44 has approximately 60% to 66% of the total purchases. The 18–24 age group (Generation Z) also participates, although to a lesser extent, with an estimated range of between 12% and 20%. Meanwhile, the influence of older adults (45+) is still limited, representing around 10–15% overall.

More than half of the products (58%) imported by e-commerce in Peru come from China, through platforms such as Temu, Shein and AliExpress, a trend that has grown in recent years. For 2025 it is expected to have more than 7 million transactions. The main products purchased come from the fashion industry (40%), passed to tech and gadgets -smartphones, chargers and others- to get to beauty (15%), home and toys, two markets that are growing in the last years.

For international organisations, success depends not only on having the right products, but also on building brand trust, optimising visibility through SEO and digital marketing, and speaking to consumers in ways that resonate culturally.

Millennials are the main online shoppers, influenced by their acquisitive power and also by their proximity to technology. This group between the ages of 25 and 44 has approximately 60% to 66% of the total purchases. The 18–24 age group (Generation Z) also participates, although to a lesser extent, with an estimated range of between 12% and 20%. Meanwhile, the influence of older adults (45+) is still limited, representing around 10–15% overall.

More than half of the products (58%) imported by e-commerce in Peru come from China, through platforms such as Temu, Shein and AliExpress, a trend that has grown in recent years. For 2025 it is expected to have more than 7 million transactions. The main products purchased come from the fashion industry (40%), passed to tech and gadgets -smartphones, chargers and others- to get to beauty (15%), home and toys, two markets that are growing in the last years.

For international organisations, success depends not only on having the right products, but also on building brand trust, optimising visibility through SEO and digital marketing, and speaking to consumers in ways that resonate culturally.

Radio remains the most widely consumed medium in Peru, reaching people even in the most remote parts of the country. For many Peruvians, especially in rural areas, it is still the main way to stay informed and connected to what is happening around them.

With an audience that covers 92 percent of the population, radio slightly surpasses broadcast television at 90 percent. More than 20.7 million people tune in every week, listening for an average of 24 hours per person. Radio Programas del Perú is the country’s leading news broadcaster, maintaining a strong presence thanks to its network of transmitters and correspondents in cities across Peru.

The advertising market in the media has tripled over the past decade, reaching $1.21 billion by 2025, demonstrating consistent growth even through challenging periods like the 2020 pandemic.

The most significant shift has been the migration of advertising to digital platforms, which now accounts for $477 million. Websites and online programmes have taken centre stage, emerging as key trends. Television channels remain a strong reference medium, with $438 million, while print media continues its steady decline, generating $96 million.

In 2023, Peru led the region in digital advertising growth, with an increase of 20%. These figures are also supported by the rise of social media and online advertising. Digital spending grew by 12.6% in 2024, almost double the growth of traditional media, which stood at 6.8%.

For international organisations, this shift highlights the need for integrated strategies that balance digital-first approaches with the enduring influence of TV and other legacy media.

The advertising market in the media has tripled over the past decade, reaching $1.21 billion by 2025, demonstrating consistent growth even through challenging periods like the 2020 pandemic.

The most significant shift has been the migration of advertising to digital platforms, which now accounts for $477 million. Websites and online programmes have taken centre stage, emerging as key trends. Television channels remain a strong reference medium, with $438 million, while print media continues its steady decline, generating $96 million.

In 2023, Peru led the region in digital advertising growth, with an increase of 20%. These figures are also supported by the rise of social media and online advertising. Digital spending grew by 12.6% in 2024, almost double the growth of traditional media, which stood at 6.8%.

For international organisations, this shift highlights the need for integrated strategies that balance digital-first approaches with the enduring influence of TV and other legacy media.

One of the ongoing challenges in Peru is media concentration, which happens not only within major business groups but also around Lima, where much of the country’s communication power is still centred.

About 84 percent of national media belongs to just three groups: El Comercio (GEC), ATV and Latina. In print, most competition occurs between Grupo El Comercio and Grupo La República. On television, América (from GEC) shares the spotlight with Latina and ATV, while radio is largely led by Grupo RPP, Corporación Radial del Perú and Corporación Universal.

As digital consumption grows, print readership continues to fall. Many outlets have responded by strengthening their online presence, launching digital editions and shifting more of their content to the web

One of the ongoing challenges in Peru is media concentration, which happens not only within major business groups but also around Lima, where much of the country’s communication power is still centred.

About 84 percent of national media belongs to just three groups: El Comercio (GEC), ATV and Latina. In print, most competition occurs between Grupo El Comercio and Grupo La República. On television, América (from GEC) shares the spotlight with Latina and ATV, while radio is largely led by Grupo RPP, Corporación Radial del Perú and Corporación Universal.

As digital consumption grows, print readership continues to fall. Many outlets have responded by strengthening their online presence, launching digital editions and shifting more of their content to the web

At Sherlock Communications, we blend deep cultural awareness with an international perspective, shaping stories that are authentic, imaginative and designed to deliver meaningful results. Our work brings together consumer brands, service-led organisations, fast-growing tech companies and businesses looking to build a stronger presence in the Peruvian market, drawing on strong local relationships, cultural fluency and decades of global experience to create impact with the people who matter most.