Sherlock Communications helps international organisations enter, grow and thrive in the Dominican Republic. Our local team combines deep on-the ground insight, trusted media relationships and digital expertise with global standards of strategy and creativity. We work exclusively with international clients, acting as a bridge between global objectives and the Dominican Republic’s dynamic, opportunity rich communications landscape.

The Dominican Republic is one of Latin America’s fastest growing economies and the largest in the Caribbean, home to more than 11 million people. Beyond its tropical beauty and biodiversity, from high mountains to protected coastal parks, the country offers a stable, connected and opportunity-rich environment for global organisations seeking to expand in the region.

A commitment to education and social progress underpins its development. With a literacy rate above 95 per cent and average life expectancy exceeding 74 years, the Dominican Republic combines a skilled workforce with improving quality of life. Around 5.6 million people make up its labour force, and unemployment remains among the lowest in the hemisphere, reinforcing the strength of its internal market.

Modern infrastructure supports this momentum. World-class airports such as Punta Cana International and Las Américas connect the country to key global hubs, while the ports of Haina and Caucedo have consolidated its role as a logistics and trade gateway for the Caribbean.

Political stability and consistent growth continue to attract record levels of investment (more than US $4.3 billion in 2023, the highest in the country’s history) confi rming its status as a preferred destination for business and innovation. For communicators and brands, this combination of economic confi dence, connectivity and openness creates fertile ground for campaigns that link international vision with local pride and progress.

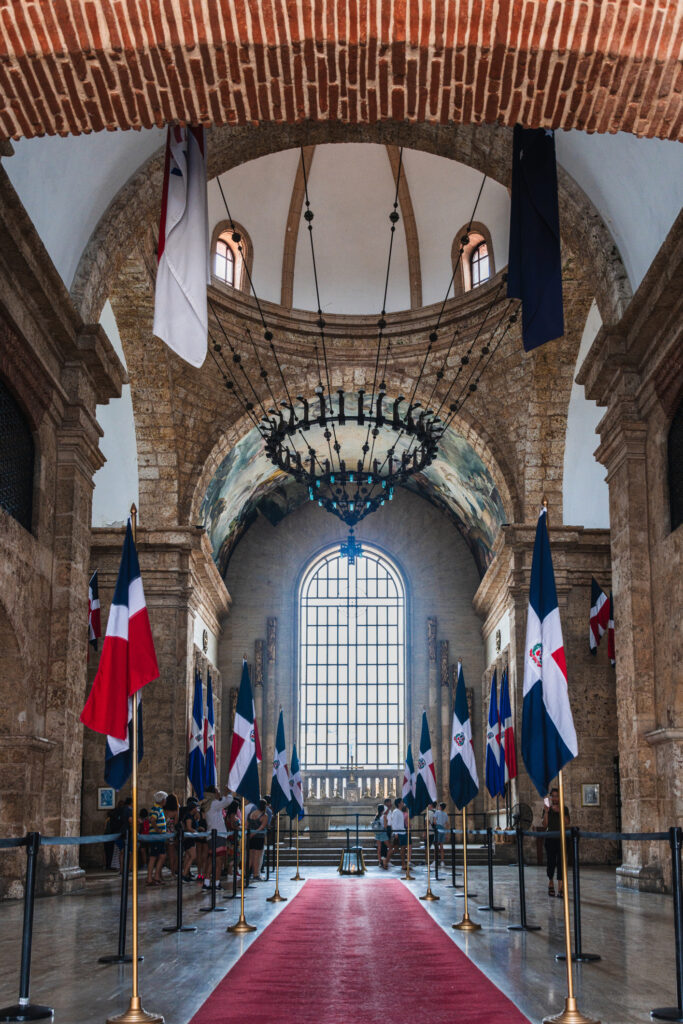

Santo Domingo is both the historical heart and the economic engine of the Dominican Republic, a city where the Caribbean’s oldest colonial streets meet one of its most ambitious, connected business environments. Its Colonial Zone, lined with cafés, museums and 16th century landmarks, refl ects the creativity and cultural pride that continue to shape how Dominicans see themselves and their place in the world.

Today, the capital is also the centre of decision-making and opportunity. Nearly 3.7 million people live in the metropolitan area, and the service sector, spanning tourism, fi nance, commerce and telecommunications, drives around 60 per cent of national GDP. For international brands, Santo Domingo offers the visibility, media concentration and talent base that make it the natural launch point for nationwide campaigns and regional partnerships.

Just a short flight away, Punta Cana anchors the Dominican Republic’s global reputation as a tourism powerhouse. In 2024, almost 60 per cent of the country’s 11 million visitors arrived through its international airport, illustrating how tourism, logistics and international connectivity are tightly interwoven. For communicators, the area’s global profi le offers fertile ground for brand activations, experiential marketing and creative collaborations that reach both local audiences and international travellers.

Tourism contributes more than US $26 billion to GDP and sustains close to one million jobs, helping defi ne the country’s image abroad. Increasingly, the Dominican Republic is also positioning itself as a hub for business events and investment, blending hospitality with professionalism; an environment where international organisations can build trust, visibility and long-term engagement.

According to Mexico’s Ministry of Economy, FDI reached a recordUS$34.27 billion in the first half of 2025, up 10.2% year-on-year, with new investments growing 3.4 times compared to 2024. The UNCTAD 2024 ranking placed Mexico 11th globally for foreign investment inflows, underscoring its strategic role as an entry point for businesses into Latin America.

The USMCA agreement has also delivered significant results: trade among Mexico, the US and Canada has increased sixfold, generating millions of jobs across the three countries. For international organisations, this integration, alongside Mexico’s strong manufacturing and logistics sectors, makes the country not just attractive, but often essential to a regional strategy. But success here requires more than optimism. Regulatory complexity, inequality and regional differences mean that brands need genuinely local insight and on the ground support to navigate the market effectively.

The Dominican Republic has consolidated its position as the Caribbean’s largest and one of Latin America’s fastest-growing economies. With GDP exceeding US $108 billion and growth around 5 per cent in 2024, it stands out for its resilience, diversification and investor confidence.

Growth is powered by tourism, construction, manufacturing in free-trade zones and strong domestic consumption. Foreign investment reached a record US $4.5 billion in 2024, led by tourism, consumer goods, telecommunications, pharmaceuticals and fi nancial services – sectors that together shape the country’s international image and demand consistent, reputation-driven communication.

Tourism remains a central pillar, generating more than US $10 billion in revenue and accounting for roughly 15 per cent of GDP. The sector’s influence goes beyond economics: it defi nes how the world sees the Dominican Republic, providing brands with unique opportunities to associate with sustainability, hospitality and cultural vibrancy.

Macroeconomic stability underpins this growth story. International reserves stand at more than US $13 billion, infl ation remains contained within the central bank’s target, and trade agreements such as DR-CAFTA and the Economic Partnership Agreement with the EU and CARICOM give the country privileged access to major markets.

For international organisations, this combination of open trade, fiscal discipline and creative energy makes the Dominican Republic one of the region’s most compelling environments for communications, investment and brand expansion. Campaigns that emphasise innovation, inclusion and shared prosperity resonate strongly in a nation that sees itself as a benchmark for stability and progress in the Caribbean.

Mexico’s consumers are increasingly shaped by a mix of technology, value-consciousness and local pride.

A 2025 Ernst & Young study shows that 75% of Mexicans expect brands to invest in innovation, while nearly half (47%) already see AI as more effective than human support. For international companies, this underlines the need for campaigns that combine creativity with technological relevance.

Digital adoption is central to this picture. According to Statista, 88% of Mexican adults own a smartphone, and 73% of online purchases are made via mobile devices. More than half (52%) of the population made at least one online purchase in the past year.

With 71% of consumers reporting they have bought a product influenced by social media ads (particularly on Facebook, Instagram and TikTok) mobile-first, social-first strategies are essential to success.

At the same time, consumer confidence is strong, with INEGI reporting a 46.7-point increase in 2025 in its Consumer Confidence Index. For international organisations, this presents a unique opportunity: with trust levels rising, brands that can demonstrate cultural relevance and deliver genuine value will be best positioned to grow.

Mexico’s consumers are increasingly shaped by a mix of technology, value-consciousness and local pride.

A 2025 Ernst & Young study shows that 75% of Mexicans expect brands to invest in innovation, while nearly half (47%) already see AI as more effective than human support. For international companies, this underlines the need for campaigns that combine creativity with technological relevance.

Digital adoption is central to this picture. According to Statista, 88% of Mexican adults own a smartphone, and 73% of online purchases are made via mobile devices. More than half (52%) of the population made at least one online purchase in the past year.

With 71% of consumers reporting they have bought a product influenced by social media ads (particularly on Facebook, Instagram and TikTok) mobile-first, social-first strategies are essential to success.

At the same time, consumer confidence is strong, with INEGI reporting a 46.7-point increase in 2025 in its Consumer Confidence Index. For international organisations, this presents a unique opportunity: with trust levels rising, brands that can demonstrate cultural relevance and deliver genuine value will be best positioned to grow.

With more than 60 per cent of Dominicans aged between 15 and 59, the country’s youthful demographic is reshaping how information is produced, shared and trusted. Media ownership remains concentrated, but audiences are highly active and multi platform, creating a vibrant and fast moving communication environment.

Television continues to command mass audiences, led by channels such as Teleantillas (Channel 2), Telemicro (Channel 5), Antena Latina (Channel 7), Color Visión (Channel 9) and Telesistema (Channel 11). Radio also retains remarkable reach, with more than 180 AM and FM stations including Z101, La Mega 97.1 FM, Zol 106.5 FM and Super 7 FM connecting communities across the country. Importantly, many listeners now follow their favourite stations through both traditional and digital channels, blurring the line between broadcast and online media.

Printed media such as Listín Diario, Diario Libre, El Caribe, El Nuevo Diario and Hoy Digital continue to infl uence the national debate, while a growing number of specialised outlets in business such as Revista Mercado, El Dinero, Diario Financiero and El Mundo de los Negocios; in tourism such as Arecoa, Resumen Turismo, La Infantería, Punta Cana Bávaro Online and Televisión Turística; and specialised health media such as Revista Médica, Medihealth, Actualidad Médica, Resumen de Turismo, Salud News and Notas Médicas.

At the same time, digital media dominates daily life. More than 7.8 million Dominicans use Facebook, 7.3 million use YouTube, and platforms like TikTok and Messenger have become primary sources of news and entertainment. Social networks are where public conversation unfolds: humour, music and commentary driving engagement far more than overt advertising.

For international brands, this hybrid ecosystem demands authenticity and agility. Success lies in integrating traditional credibility with digital immediacy: using trusted news outlets to build reputation, while leveraging social platforms for creativity, humour and cultural connection. Campaigns that speak in a relatable tone, celebrate Dominican identity and encourage participation perform best in this highly interactive market.

The Dominican Republic stands as the Caribbean’s largest and most diversified economy, with nominal GDP surpassing US $130 billion in 2024 and annual growth of around 5 per cent. This expansion refl ects a balanced mix of mature industries and emerging sectors, a combination that offers opportunities for brands seeking visibility, partnerships and sustained growth.

Tourism remains the flagship of the national economy, welcoming more than 11 million visitors in 2024 and generating over US $10 billion in revenue. From Punta Cana’s global allure to Santo Domingo’s cultural heritage and Puerto Plata’s growing leisure scene, the tourism sector continues to defi ne the country’s international image. For brands, these destinations provide powerful settings for creative campaigns that connect with both locals and international audiences.

Manufacturing in free-trade zones has become another strong pillar. With more than 200 companies in textiles, electronics and pharmaceuticals, this sector demonstrates the country’s openness to innovation and global supply chains; key attributes for organisations communicating around technology, quality and sustainable production.

Construction and infrastructure show consistent expansion, driven by tourism, real estate and urban development. This ongoing modernisation shapes the way Dominicans live and work, creating opportunities for campaigns that highlight progress, design and local transformation.

Financial services are equally dynamic. Over 30 commercial banks and a surge in mobile banking have made fi nancial inclusion and digital access central to public conversation, topics where thoughtful communication can build trust and leadership.

Together, these sectors form an ecosystem that rewards authenticity and insight. The Dominican Republic’s blend of stability, ambition and creativity makes it a prime market for brands ready to engage deeply with its people and culture.

Crisis management in the Dominican Republic requires agility, empathy and strong local relationships. Media ownership remains concentrated, while social networks amplify stories at high speed; meaning that public opinion can shift quickly and unpredictably. In major cities, audiences follow news and commentary largely through social media and television, whereas in rural areas radio and community media still hold deep trust and influence.

Because of this diversity, one-size-fi ts-all responses rarely work. Effective crisis communication must be segmented by geography, age and channel; combining fast digital reaction with traditional outreach and personal dialogue. Messages that sound authentic, consistent and respectful of local sensibilities are far more likely to calm tensions and protect reputation.

Trust is the foundation of any successful response. Organisations that maintain regular contact with journalists, infl uencers and community leaders are better positioned to react swiftly and credibly when challenges arise. Personal connection, still central to Dominican culture, helps prevent misinterpretation and reduces the risk of crises being magnifi ed across platforms.

For international brands, this underscores the importance of preparation and partnership. Working with a local Dominican agency ensures access to real-time insights, established media networks and cultural guidance, turning potential crises into opportunities to demonstrate transparency, empathy and long-term commitment to the market.

According to INEGI, 96.5% of Mexicans live in family households, with an average of four people per home. In many traditional families, women still play the leading role in purchasing decisions, while younger households tend to share responsibilities more equally. Across both, family gatherings and social events remain important consumption moments.

Gastronomy is important in both cultural and economic terms. In 2010, UNESCO recognised Mexican cuisine as Intangible Cultural Heritage of Humanity, a designation that continues to shape national pride and identity.

Gastronomy also drives economic activity: Mexico’s Ministry of Tourism estimates that food generates 245.46 billion pesos annually, representing 30% of tourism consumption.

Every Latin American market has its own rhythm and codes of connection, and the Dominican Republic is no exception. Relationships here are personal, built on warmth, courtesy and time. Success in communications depends as much on tone and consistency as on strategy.

Trust is earned gradually. Business relationships often begin formally but quickly evolve into closer, more personal interactions once credibility and goodwill are established. Brands that combine professionalism with approachability, showing genuine respect for people and culture, are welcomed far more readily than those perceived as distant or purely transactional.

Urban audiences, particularly in Santo Domingo, Santiago and La Romana, are highly connected and responsive to social media, while rural communities rely more on radio and local networks. Overlooking these regional differences risks excluding important audiences. An integrated approach that values both traditional and digital channels ensures broader reach and stronger engagement.

Cultural diversity is another vital consideration. Most Dominicans identify as mixed race, and pride in this diversity runs deep. Campaigns that highlight inclusion, optimism and community spirit tend to resonate widely, while those that rely on stereotypes or imported imagery often miss the mark.

Language and tone also carry weight. Spanish is universal, but local expressions and a friendly, conversational style can make communication feel authentic and human. Humour, music and sport, especially baseball, remain powerful ways to build emotional connection.

In short, effective communication in the Dominican Republic requires listening before speaking, building relationships before campaigns, and showing commitment beyond commercial goals. Brands that understand this balance are rewarded with loyalty, credibility and genuine advocacy.

Expanding operations in the Dominican Republic demands more than translation; it requires genuine cultural fluency and a clear understanding of how people connect, consume and form opinions. Partnering with a local team that combines first-hand insight with international perspective is essential for building trust and long-term relevance.

With more than 89 per cent of Dominicans online, digital platforms are central to daily life. Social media is where news breaks, communities gather and purchasing decisions are made. Yet television and radio still play a crucial role, particularly among adults and rural audiences. The most effective communication strategies recognise this dual reality combining the immediacy of digital engagement with the credibility and reach of traditional media.

Strong campaigns in the Dominican Republic share a few traits. They build authentic relationships with journalists and infl uencers, ensuring messages are grounded in local context. They use creative content that celebrates Dominican values, warmth, optimism and community, while tailoring tone and format to each audience. They also prioritise accessibility: making sure information is easy to fi nd, understand and share. Finally, they anticipate risks by maintaining open, transparent communication with media and stakeholders.

This integrated approach allows brands to connect with young urban audiences and family-oriented rural communities alike. Working with a local agency turns this understanding into action, ensuring messages are not only seen and heard, but felt and trusted across the country.

Festivities are a major trigger for spending. National holidays and celebrations such as Independence Day, Day of the Dead and Christmas posadas regularly spark peaks in household consumption.

Some studies suggest food and beverage spending can rise by as much as 40–50% during Independence Day celebrations, while research into middle-income urban households indicates that annual spending on celebrations can represent a significant share of household budgets.

For international brands, these numbers reinforce a key message: campaigns that embrace cultural identity, traditions and everyday family life are far more likely to resonate with Mexican consumers than those that simply replicate global playbooks.

When it comes to social platforms, Facebook dominates, with one in three respondents naming it the most trustworthy news source. Twitter (28%) and YouTube (20%) also scored highly, while WhatsApp (8%), LinkedIn (5%) and Instagram (just 4%) ranked lower.

For international organisations, the implication is clear: media strategies must reflect Mexico’s unique trust patterns. While Instagram can drive success in markets such as Brazil, in Mexico Facebook, Twitter and YouTube may offer stronger opportunities for PR and digital campaigns.

Like much of Latin America, Mexico’s media still has blind spots in representing diversity, from the LGBTQIAP+ community to women, people with disabilities and indigenous peoples.

For brands entering the market, this lack of representation creates both a challenge and an opportunity: campaigns that engage authentically with diverse communities stand out and resonate more deeply.

Expanding in the Dominican Republic requires more than a communications plan, it demands understanding how people think, connect and make decisions. At Sherlock Communications, we combine local insight with global strategy to help international brands build credibility, relevance and measurable impact in one of the Caribbean’s most vibrant markets.

Our 360° approach brings together every aspect of modern communication.

Working with our local team gives you access to trusted networks, fi rst-hand insights and a deep understanding of Dominican audiences and media. The result is communication that goes beyond visibility, building genuine connection, trust and long-term growth for your brand.